How it works

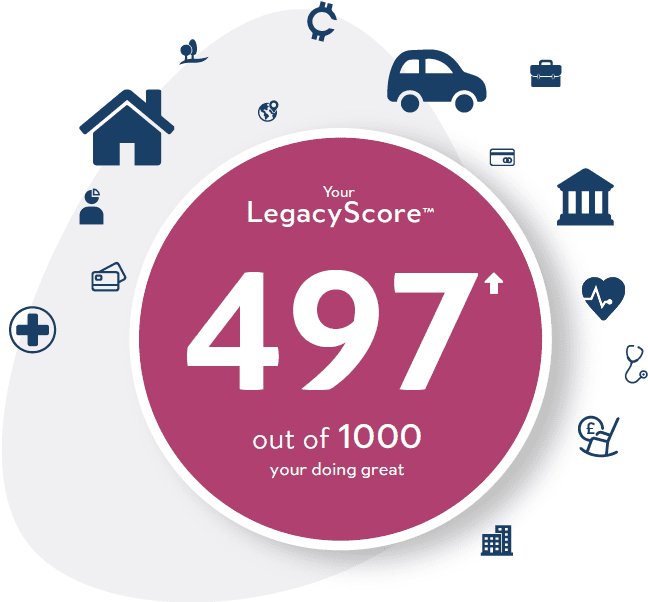

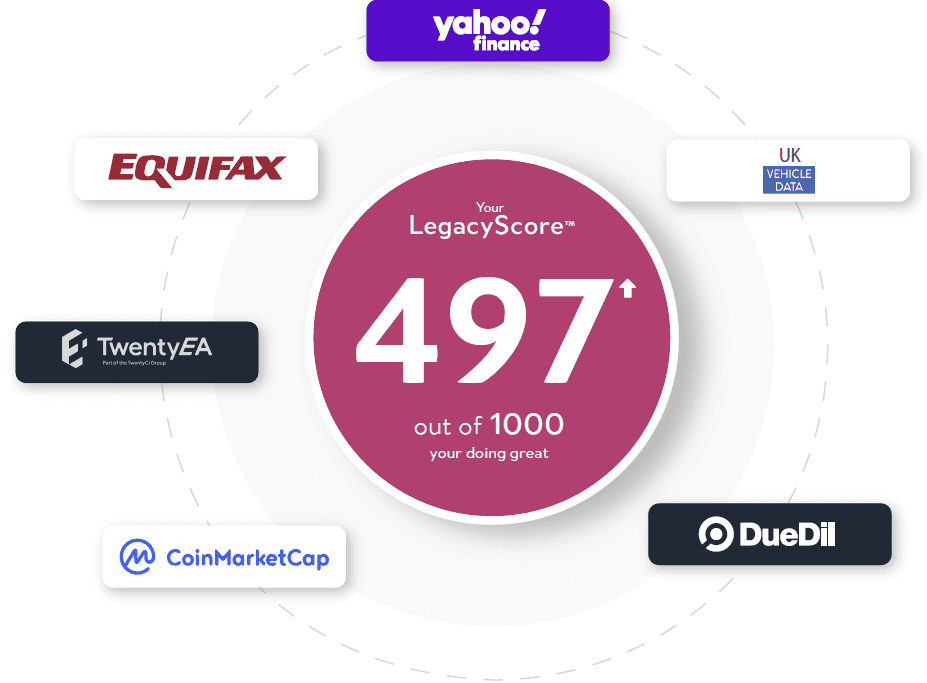

How is your LegacyScore calculated?

Your LegacyScore is based on the information you disclose to us and will be updated monthly. For example bank accounts, properties, vehicles, insurances.

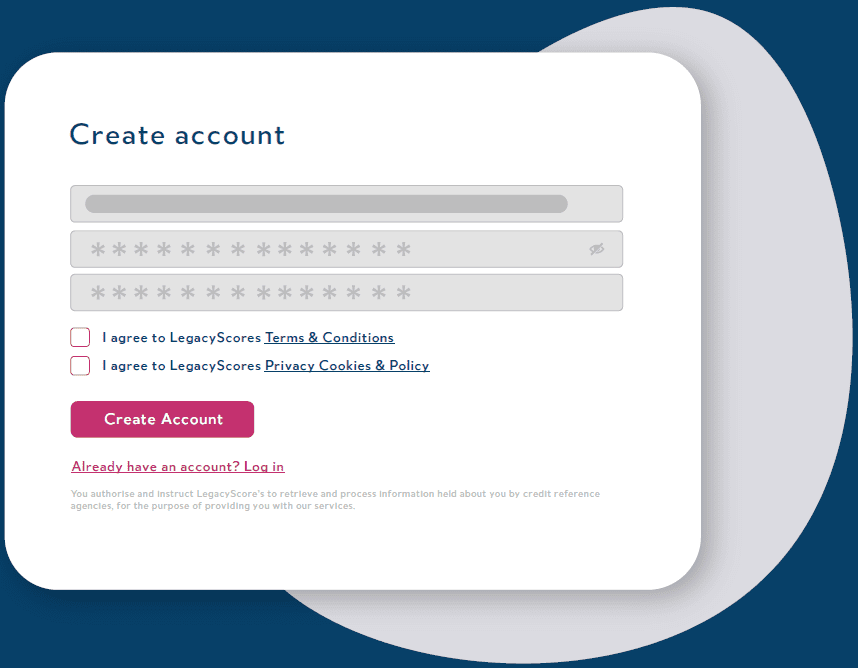

Your security is of the utmost importance to us, we use powerful security to protect your account.

Sign up

Helping people understand they have a personal set of assets as well as debts and that they need to reprioritise their efforts on their assets and insurances to get the best outcome for their families.

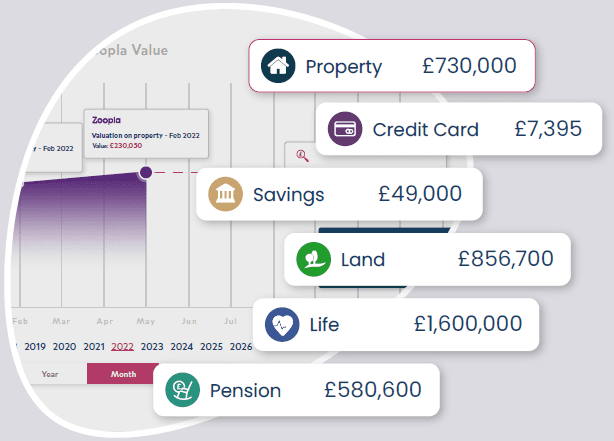

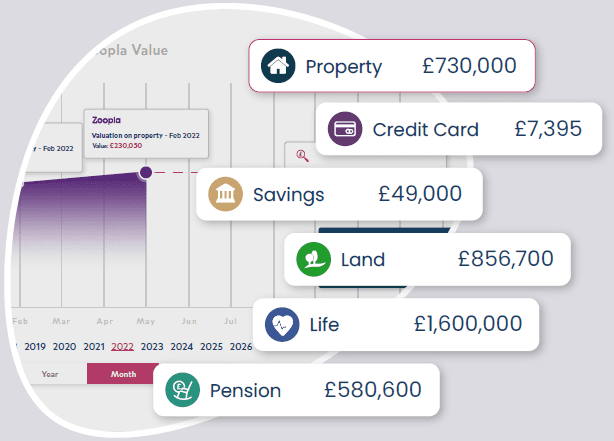

Tell us about your assets

To inform owners of the value of assets and provide an unfair advantage to our users on the merits of each asset class within the context of the current economic climate

Leave the rest to us

Once you build your Legacyscore by adding on your assets and uploading your documentation, leave your Will and plan your legacy. Allow us to look after your today, tomorrow and after.

Your LegacyScore is composed of

Financial Competency

The implementation and application of financial literacy rules to your portfolio

Relations

Values the relationships you hold with family and friends.

Legacy Plan

Provides you with the ability to plan the financial distribution of your wealth amongst your beneficiaries.

Will Document

Protects your Legacy and ensures your wishes are supported ensuring those you intend to benefit from your legacy.

Financial Literacy

is about making financial decisions which are going to increase your net worth.

Goals

What do you want to achieve in life? What do you want to achieve with your legacy?

Insurance

A contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils.

Validation

Validation is a process of proving the existence and the ownership of your assets, debts and insurance.

Assets

An asset is something containing economic value and/or future benefit. An asset can often generate cash flows in the future.

Debts

Debt is money borrowed by one party from another.

Financial Competency

The implementation and application of financial literacy rules to your portfolio

Relations

Values the relationships you hold with family and friends.

Legacy Plan

Provides you with the ability to plan the financial distribution of your wealth amongst your beneficiaries.

Will Document

Protects your Legacy and ensures your wishes are supported ensuring those you intend to benefit from your legacy.

Financial Literacy

is about making financial decisions which are going to increase your net worth.

Goals

What do you want to achieve in life? What do you want to achieve with your legacy?

Insurance

A contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils.

Validation

Validation is a process of proving the existence and the ownership of your assets, debts and insurance.

Assets

An asset is something containing economic value and/or future benefit. An asset can often generate cash flows in the future.

Debts

Debt is money borrowed by one party from another.

Help us build the Financial planner of the future you want to use

Your Legacy matters

Not only does it mean keeping your financial affairs in order and some sort of control over your assets, but it can also legally protect, and support loved ones.